Demystifying Semi-Monthly Payroll: A Comprehensive Guide

Managing payroll is a critical aspect of any business, ensuring that employees are compensated accurately and on time. One common payroll schedule is the semi-monthly payroll, which involves paying employees twice a month. In this guide, we will delve into the details of semi-monthly payroll, exploring its benefits, challenges, and best practices for implementation.

Understanding Semi-Monthly Payroll:

Semi-monthly payroll, also known as bi-monthly payroll, involves paying employees on two specific dates each month, usually around the 15th and the last day of the month. Unlike a bi-weekly payroll that consists of 26 pay periods per year, a semi-monthly schedule typically results in 24 pay periods annually.

Benefits of Semi-Monthly Payroll:

- Consistency: Semi-monthly payroll offers a predictable pay schedule, making it easier for employees to manage their finances.

- Compliance: It simplifies compliance with labor laws and overtime regulations since you are dealing with fewer pay periods.

- Budgeting: Employees can budget more effectively as they receive paychecks on regular, fixed dates.

- Administration: The semi-monthly schedule can reduce administrative workload by streamlining calculations and data entry.

Challenges of Semi-Monthly Payroll:

- Varying Workdays: Calculating wages for hourly employees can be complex due to the variation in the number of workdays per pay period.

- Overtime Calculations: Overtime calculations might be more intricate because overtime is often based on a weekly rather than a bi-weekly period.

- Month-End Deadlines: Payroll processing at the end of the month can be challenging due to coinciding with other accounting and financial tasks.

Implementing Semi-Monthly Payroll:

- Choose Pay Dates: Select two fixed pay dates each month. Ensure they align with business cash flow and are in compliance with local labor laws.

- Update Payroll System: Adjust your payroll software to accommodate the semi-monthly schedule. Double-check tax withholding calculations and ensure accurate deductions.

- Communication: Inform your employees of the new pay schedule and ensure they understand how their salaries will be calculated.

- Hourly Employees: For hourly employees, establish a clear method for tracking hours worked and calculate their wages based on the specific pay periods.

- Overtime Calculations: Determine how you will handle overtime. Consider using a weekly overtime threshold to simplify calculations.

- Record Keeping: Maintain thorough records of hours worked, wages paid, and any overtime calculations to ensure compliance and transparency.

- Month-End Adjustments: Establish a process to handle month-end adjustments and ensure timely payments, especially if the last day of the month falls on a weekend or holiday.

Best Practices for Semi-Monthly Payroll:

- Automate Processes: Utilize payroll software to automate calculations, tax deductions, and direct deposits, reducing the risk of errors.

- Provide Resources: Offer employees access to online tools or resources that help them understand their paystubs and calculations.

- Regular Audits: Conduct regular audits to identify and rectify any discrepancies or errors in payroll processing.

- Stay Updated: Stay informed about changes in labor laws, tax regulations, and overtime rules to ensure ongoing compliance.

- Employee Feedback: Encourage employees to provide feedback on the new pay schedule and address any concerns promptly.

In Conclusion:

Semi-monthly payroll can provide numerous benefits to both employers and employees. While it comes with its own set of challenges, careful planning, accurate calculations, and effective communication can help mitigate these issues. By implementing best practices and leveraging modern payroll technology, businesses can streamline their payroll processes and ensure that employees are compensated accurately and on time. Remember, open communication and adaptability are key to a successful transition to a semi-monthly payroll schedule.

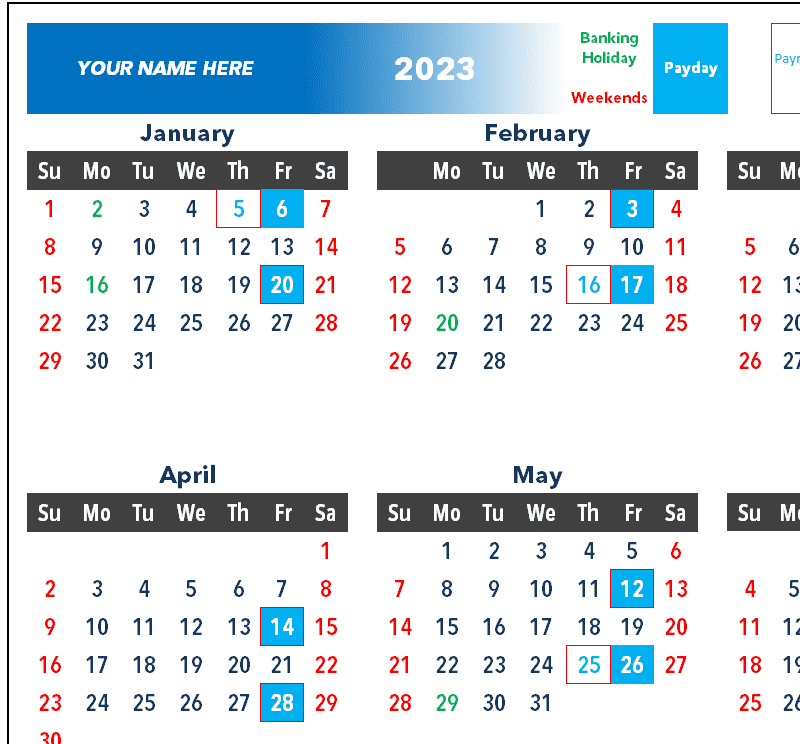

Need to Create a Custom Payroll Calendar?

Click on on the Lets Get Started Botton and create you custom Calendar.